04

Nov 2019

- News and Press

- Studies

Fintech : The genius will not turn back to his bottle

“WealthTech: Wealth and Asset Management in the Fintech Age” is the primary resource for the wealth and asset management technology revolution. It examines the rise of financial technology and its growing impact on the wealth and asset management industry. Written by thought leaders in the global WealthTech space, this volume offers an analysis of the current tectonic shifts happening in wealth and asset management and aggregates diverse industry expertise into a single informative book. It provides practitioners such as wealth managers, bankers and investors with the answers they need to capitalize on this lucrative market. As a primer on WealthTech it offers academics clear insight into the repercussions of profoundly changing business models. It furthermore highlights the concept of the ongoing democratization of wealth management towards a more efficient and client-centric advisory process, free of entry hurdles.

This book aggregates facts, expertise, insights and acumen from industry experts to provide answers on various questions including: Who are the key players in WealthTech? What is fueling its exponential growth? What are the key technologies behind WealthTech? How do regulators respond? What are the risks? What is the reaction of incumbent players?

A study conducted by Pericles Consulting in 2017 shows that 71% of major Assets Managers collaborate with startups and Fintechs.

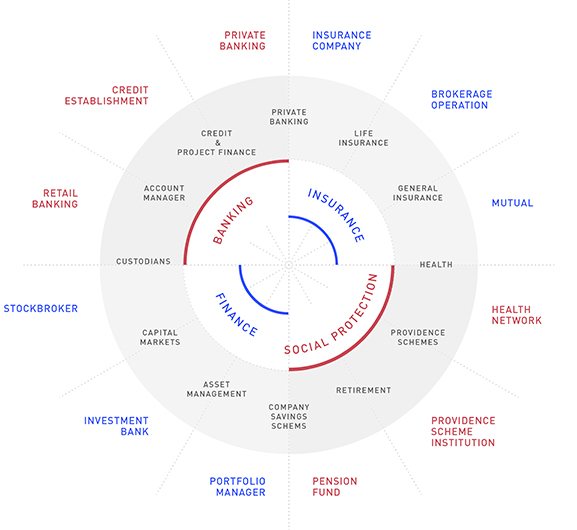

When traditional financial services players need to adapt quickly their product and service offerings to a quick sociological and technological changes, Fintechs offer smart solutions to accelerate the time to market of “turnkey” innovations based on new technologies. Beyond that, Innovation management and the choice of collaboration model with Fintechs are key factors of Investment and wealth management companies.

Here’s an extract from the article :

The really first Fintech generation is a consequence of the subprime crisis occurred in 2008. When financial and banking institutions collapsed, a lot of executives and top managers were sacked or decided to quite their golden cage job. Some of them wanted to reshape financial services with innovative products and a new user experience. This wave of newcomers with a “Silicon Valley” style (no more tie and jacket) used technology to propose products and services that compete frontally the traditional bankers. Few years ago, we were talking about the uberization of finance. Some said that Fintechs would disrupt Banks. This mindset changed very quickly.

You can purchase the book here.

Feel free to watch our FinTech interviews One Week One Tech