07

Apr 2020

- News and Press

Online banking, Neobanks, Fintech, Insurtech, Robo-advisor…?

Published by : L’AGEFI Luxembourg

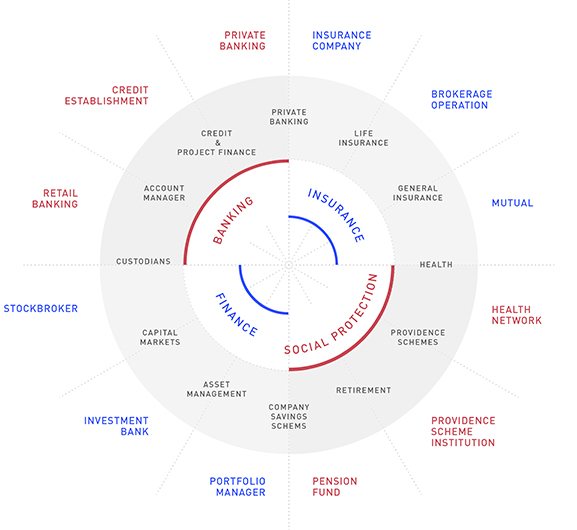

Traditionally, on the international life insurance market, Luxembourg players favor the Wealth Management segment. Few players consider that self-service distribution (SSD) could be used to disseminate new offers via digital distribution channels. Luxembourg life insurers typically use distribution channels such as private banks, family offices and brokers with private customers.

Many Neobanks have brought a notion of distribution of banking and financial products to several European countries (N26, Revolut…). Luxembourg Life Insurance has historically been taken internationally, just like these neobanks. Would there be a special opportunity to connect these two types of actors? To answer this question, a brief analysis of the market for traditional neobanks and online banks should be provided here as an illustration on the French and Italian markets.

In France, the history of the digitalization of banking services began some twenty years ago with adventures that are now part of the past such as SelfTrade, E-Rothschild, Zebank … The first online banks to have entered the French market were structured between 2005 and 2010. Some have now acquired a dominant position: Boursorama, Monabanq, ING Direct and Fortuneo. The Crédit Agricole and BNP groups also wanted to create their online banking brand a little later with BforBank on the one hand and HelloBank! on the other hand.

These online banks all offer online life insurance with insurance partners such as Generali, Suravenir, Spirica and Cardif. Alongside these “traditional” online banks, the phenomenon of Neobanks, Fintechs, Insurtechs and innovative start-ups has emerged. All these new companies were built around a very specific offer.

Among the biggest successes: Nickel, Lydia, N26 and Revolut. Nickel, mainly in France, has developed its success on its offer of means of payment accessible to tobacconists, for a population that does not have easy access to banking. Lydia, also in France, is built from a student population and favors shared and instant payment.

Both N26 and Revolut are structurally oriented internationally and already claim millions of users. The elements of differentiation here are the favorable exchange rates and very limited fees. It would be legitimate for these players to offer savings products and why not life insurance products. Luxembourg Life Insurers with expertise in the European market could be legitimate as a partner of these Neobanks.

In parallel with the emergence of the Neobanks, new start-ups, which come in the form of a robot advisor, are offering new online life insurance offers based on French Insurer partners. These companies, such as Yomoni, Grisbee and Advize, offer fully digitized, innovative underwriting customer journeys, sometimes based on artificial intelligence. These actors with equally international ambitions could be led to seek insurance partners on the Luxembourg market.

Older players were already positioned in online life insurance brokerage: Altaprofits, Linxea, Mes-placements.fr, Hedios… Altaprofits is one of the few players to offer online life insurance in Luxembourg alongside its offers French with its partner Generali Luxembourg. In Italy, the market seems more conservative than France. Few new players stand out in the distribution of online banking and financial products. This can be explained by a relatively low rate of internet use for banking operations. Only a third of the population uses the internet to view their bank accounts.

To date, some players are nevertheless doing well in this area: N26, Webank (Italian online banking), CheBanca! … 100% online life insurance is starting very gradually in Italy, especially with CheBanca! At first glance, you might think that Luxembourg life insurance would not have much to do in the distribution of its products to 100% digital partners. Despite many players that may emerge, the market has yet to see a real boom, pushing back traditional players.

However, the long-term vision of the distribution of banking and financial products at European level, carried by players who disrupt the market, could leave room for players in international life insurance in Luxembourg, the only ones capable in Europe of project on several markets. The future will tell us whether Luxembourg players will be able to modernize their tools and processes to address this market.

Yohann Niddam – Périclès Luxembourg et Cyril Escassut – Périclès Luxembourg

Other news

14

Sep 2021

- News and Press

The bumpy road of PRIIPs

13

Jul 2021

10

May 2021

03

Jun 2020

- News and Press